Compound rate of return calculator

Internal Rate of Return IRR Calculator. One of the greatest limitations of the compound annual growth rate is that it ignores volatility.

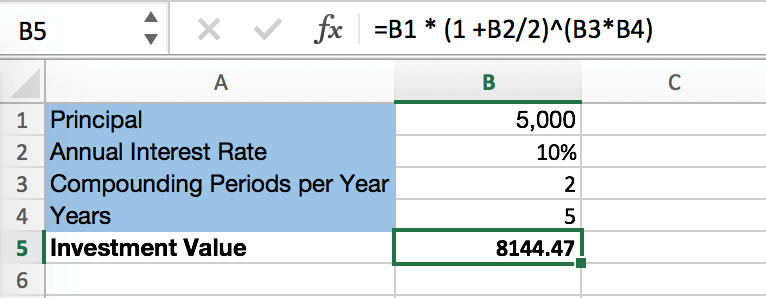

Calculate Compound Interest In Excel How To Calculate

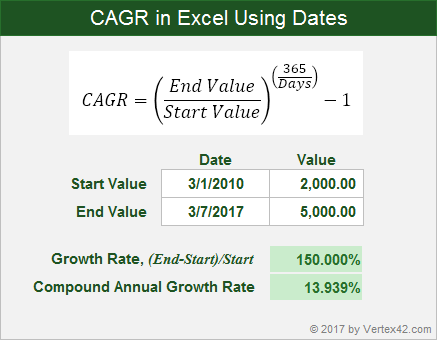

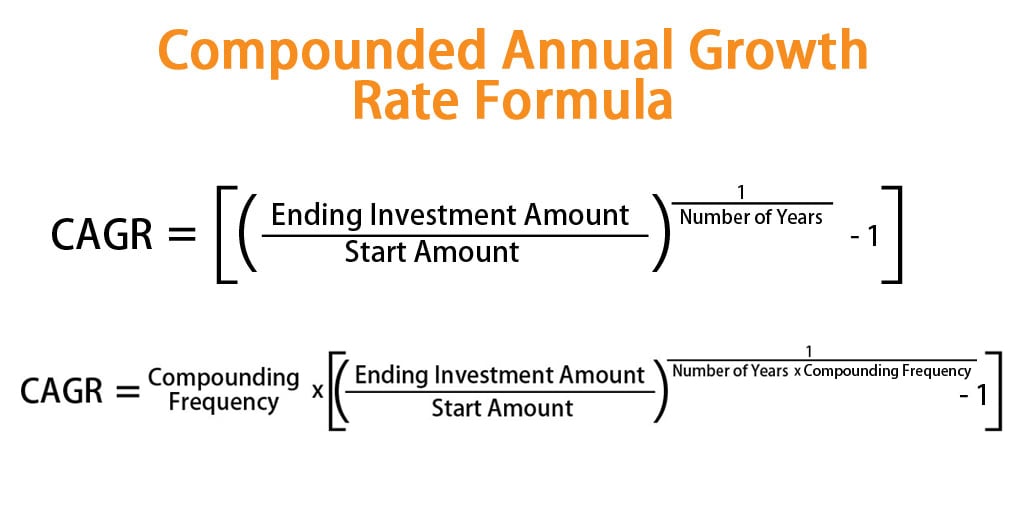

Compound Annual Growth Rate.

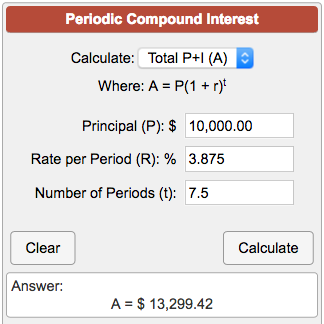

. Our all-in-one calculator app. The calculator will use the equations. This is where you enter how much compound interest you expect to receive on an investment or pay on a debt.

8 20160408 0001 50 years old level High-school University Grad student Very. Times per year that interest will be compounded. The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year.

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. That is why if we annualize the daily compound interest it would always be higher than the simple interest rate. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account.

This rate of return calculator estimates the profitability of a business or investment measured by its discount rate which is also known as compound annual growth rate. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return. From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 113 source.

The potential rate of return offered by compound interest financial instruments is often higher than those that offer simple interest particularly when compounding is part of a long-term strategy that includes making frequent contributions to a fund or portfolio. To get the CAGR value for your investment enter the starting value or initial investment amount along with the expected ending value and the number of months or years for which you want to calulate the CAGR. The nominal rate is the stated rate or normal return that is not adjusted for inflation.

In reality CAGR hides the fact that your investment return could be much higher or much lower in an individual year which can come as a big shock to a new investor experiencing those highs and lows for the first time. At the age of 65 when he retires the fund will. Compounded over the last 23 years monthly the return is approximately 4.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. On the surface it appears as a. Since 1970 the highest 12-month return was 61 June 1982 through June 1983.

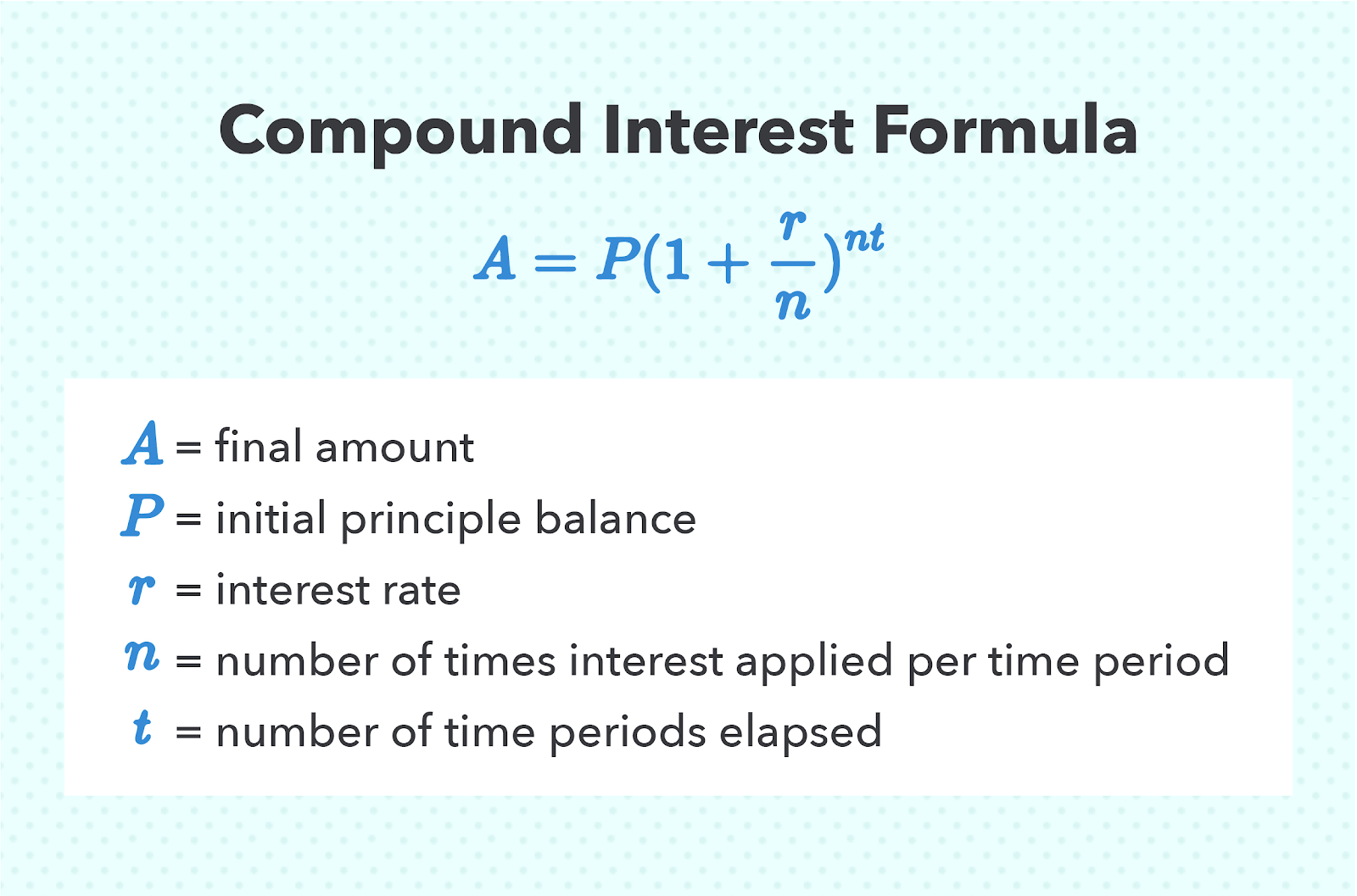

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Annualized Rate 1 ROI over N. The Annualized Rate of Return Calculator helps you determine the compound annual growth rate CAGR of your investments.

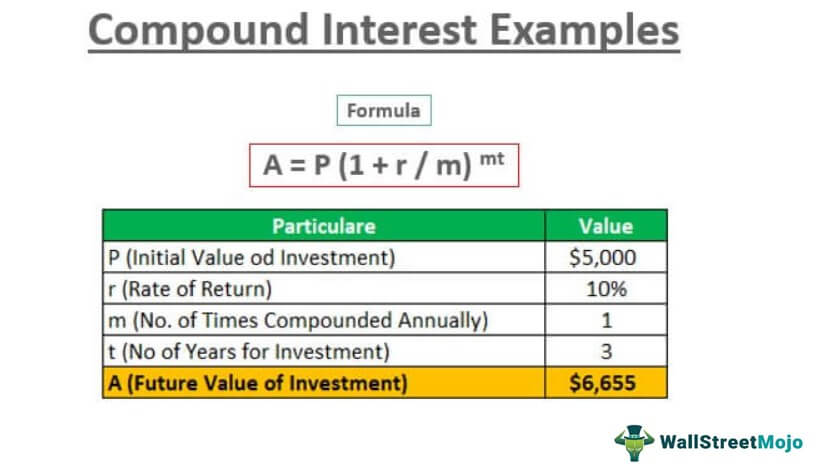

If you as the investor were strictly making your decision based on IRR you would purchase Machine 2 as this machine would generate higher cash flows. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings.

Compound Daily Interest Calculator. Guess. The rate of inflation is calculated based on the changes in price indices which are the price on a group of goods.

Calculates a table of the future value and interest using the compound. For any typical financial investment there are four crucial elements that make up the investment. Daily compounding is when our daily interestreturn will get the compounding effect.

XIRR or the Irregular Internal Rate of Return is the discount rate where the net present value of all cash flows in an investment equal to zero. Not a great return. The annualized rate of return also called the compound annual growth rate CAGR is how much.

Average annual rate of return. CAGR Calculator is free online tool to calculate compound annual growth rate for your investment over a time period. The algorithm behind this rate of return calculator uses the compound annual growth rate formula as it is explained below in 3 steps.

If you have an 8 interest rate you will enter that here. Initial Investment Cash Flow. The Compound Interest Calculator below can be used to compare or convert the interest rates of different compounding periods.

As a simple example a young man at age 20 invested 1000 into the stock market at a 10 annual return rate the SP 500s average rate of return since the 1920s. Years at a given interest. Return rate For many investors this is what matters most.

Compound Interest Explanation. The interest can be compounded annually semiannually quarterly monthly or daily. Find out the initial principal amount that is required to be invested.

The formula for calculating average annual interest rate. The lowest 12-month return was -43 March 2008 to March 2009. The concept is such that it assumes that the interest earned every day is reinvested at the same rate and will get increased as time passes.

Compound Annual Growth Rate - CAGR. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. See how much you can save in 5 10 15 25 etc.

Or compound rate of return for Machine 2 is 2004. You can also. An annualized rate of return is the return on an investment over a period other than one year such as a month or two years multiplied or divided to give a comparable one-year return.

Include additions contributions to the initial deposit or investment for a more detailed calculation. Return Rate Formula. First divide the Future Value FV by.

Return to Top. This will standardize your returns to a per year figure which shows you your true long term average portfolio performance. Estimate Your Rate of Return.

See the CAGR of the SP 500 this investment return calculator CAGR Explained and How Finance Works for the rate of return formula. Even small deposits to a. To compute compound interest we need to follow the below steps.

In the calculator above select Calculate Rate R. To improve this Compound Interest FV Calculator please fill in questionnaire. Range of interest rates above and below the rate set above that you desire to see results for.

R nAP 1nt - 1 and R r100. Return Rate Discount Rate CAGR Calculator. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. The rate of return on many investments is speculative so entering an average number can give you an idea of how much youll earn over time. It shares that with the IRR although the XIRR is more complicated to calculate because it assumes cash flows are irregular that is there isnt a fixed time of month or the year where you can.

Cagr Calculator Compound Annual Growth Rate Formula

Compound Interest Definition Formula How It S Calculated

Walletburst Compound Interest Calculator With Monthly Contributions

Compounded Annual Growth Rate Formula Calculator Excel Template

Periodic Compound Interest Calculator

Compound Interest Formula In Excel And Google Sheets Automate Excel

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Capitalize On Uninterrupted Compound Interest Wealth Nation

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Formula With Calculator

Compound Interest Calculator Daily Monthly Yearly

Excel Formula Cagr Formula Examples Exceljet

Formula For Calculating Cagr In Excel

/CAGR-ADD-V1-d9d3f4abb2be4b019cd9fdc9820803d4.png)

Compound Annual Growth Rate Cagr Formula And Calculation

What Is Compound Interest How To Calculate It

Formula For Calculating Cagr In Excel

Compound Interest Examples Annually Monthly Quarterly